TL;DR: The market’s trillion-dollar AI boom is built on one assumption: whoever spends most on infrastructure wins. DeepSeek briefly exposed how fragile that belief is, and how quickly the system could unravel if it’s wrong. It could happen again.

On the last Monday of January, markets lost over a trillion dollars in value. Nvidia alone shed roughly $593 billion, the largest single-day drop in U.S. stock market history.

The cause: DeepSeek R1, an open-source model from China trained for a fraction of the cost of frontier systems. Its release shook market confidence by calling into question the industry maxim that whoever has the most infrastructure wins. (This reevaluation didn’t last long, and by the next day the markets had recovered.)

Nine months later, the market sits at new highs, and infrastructure spending has gone from big to absurd. OpenAI alone has pledged over $1 trillion for computing infrastructure over the next decade—against just $13 billion in annual revenue, a staggering 1:77 ratio.

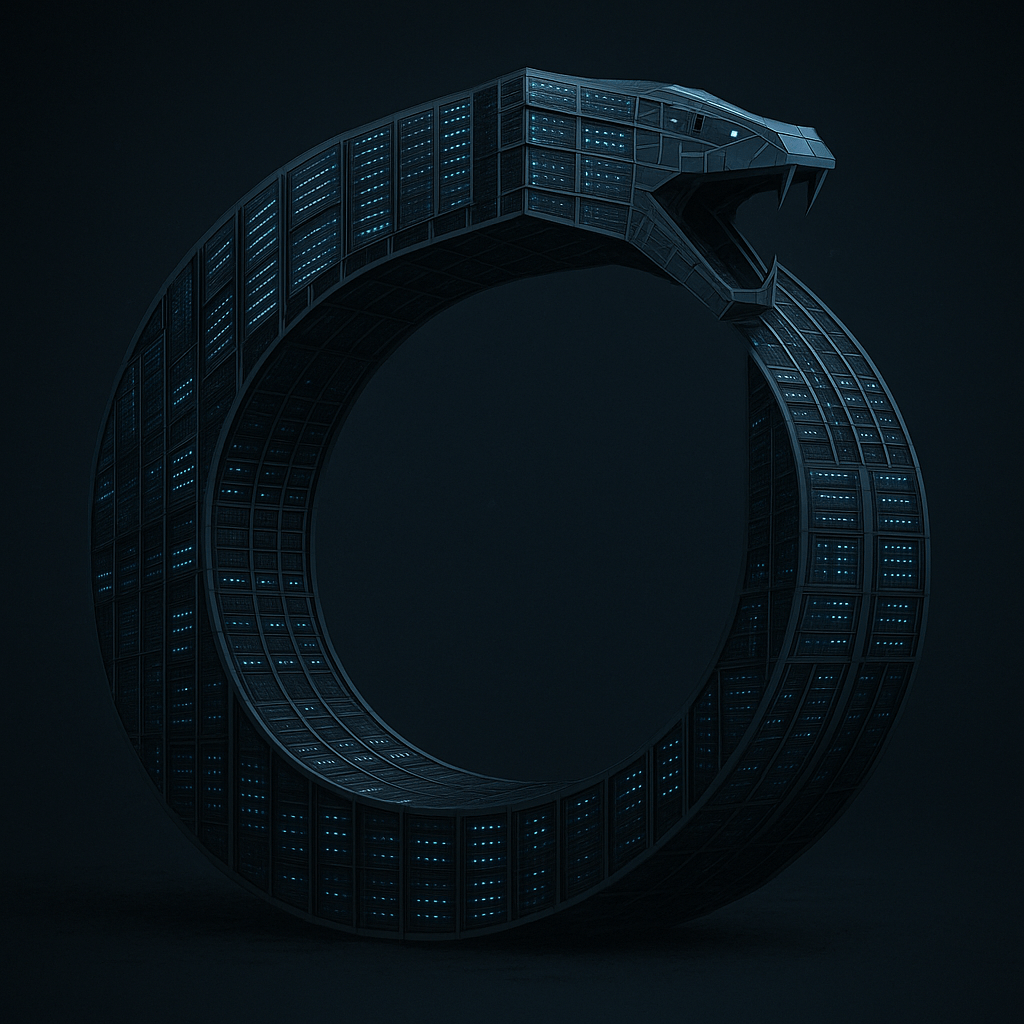

We’ve entered the age of circonomics: a closed-loop economy where companies are simultaneously customers, suppliers, and investors in each other’s ecosystems. Instead of paying cash, they trade equity, warrants, and GPU access, often leasing back what they’ve sold in increasingly circular agreements. The system resembles a tangled web of interdependence, so tightly coupled that the failure of a few players could destabilize the entire ecosystem.

A single breakthrough, whether in architecture, algorithmic efficiency, or data movement, could render these trillion-dollar bets obsolete overnight. DeepSeek already proved that “bigger is better” isn’t a law of nature. A new open-source model that’s merely “good enough” could shift value upward, from infrastructure to applications, undermining the capital structure beneath today’s AI giants.

This in turn could ripple through markets, exposing how much of today’s prosperity depends on the myth of infinite scale.

AI is unquestionably a once-in-a-generation technological shift. The question is whether it truly requires mythic levels of capital expenditure to get there. When the correction eventually comes, AI won’t die; it will evolve. The next phase will reward efficiency over magnitude: smaller, modular models, decentralized compute, open source and open architectures.

In short, disruption won’t end AI, it will force it to grow up.